We all know it’s coming. Creeping in over the horizon.

On April 6 2022, National Insurance (NI) contributions will rise by 1.25 percent, an increase which will become the Health and Social Care Levy (HSCL) from 2023.

This hike in tax, especially against the backdrop of the sharply increasing cost of living, will undoubtedly be on the minds of your people. When it comes to the increases, they’ll be looking at ways to soften the blow – this might include stopping their share plan contributions or cashing them in. They may also be less inclined to take you up on any share plan invitations.

In October last year, a month after the government announced the increase, the Express reported on a NerdWallet survey of 1,000 employed people living in the UK. The results showed seven in ten Brits expected to change their financial behaviour as a result of the tax increases. Of course they might do that when they can see their money isn’t going as far and they’re bombarded with worrying news headlines.

Ease financial anxiety: give back control

All this uncertainty can lead to anxiety. The less we know, the less we feel we have control. And with financial stability being so important to our lives and wellbeing, a lack of control in this area can make people nervous. So how can you reassure your share plan participants when it comes to the NI hikes and the HSCL? And how can you encourage take up when many are unsure about committing to a share plan right now?

The answer is: help your people get back some sense of financial control and show them where they stand. Fill in those knowledge gaps from the outset. And as we wrote about in our blog on inflation and the impact on employee share plan buy-in, if you show your employees that you’re in tune with the financial pressures they face, they’ll feel more in control of their financial future, especially during turbulent times.

How will the NI rise impact share plans?

So what exactly are those knowledge gaps that need filling? We all know the rise will impact our salaries, but do employees know how the hike affects their share plans?

It all depends on the type of share plan.

SAYE share plans

For save as you earn (SAYE, also known as sharesave) the increase in NI and the introduction of HSCL doesn’t directly impact participants, as the plan contributions are made from post-tax pay. But it does indirectly impact the taxed pay the contributions come from – because the net salary the deduction is taken from will be lower than before the hike. It’s important to clearly communicate this with your share plan participants.

EMI & CSOP share plans

EMI and CSOP only tend to attract tax, NI and HSCL for participants in specific circumstances:

- If they’ve been granted a discounted share option.

- If there’s been a disqualifying event.

- For a CSOP, if a participant exercises their share option within 3 years.

You’ll need to let your employees know that if a taxable event happens, April’s rise in NI will lead to an increase in tax payable on these plans.

SIP share plans

Of the four tax-beneficial plans in the UK, employees in a SIP who remove their shares from the plan within 5 years will be most impacted by the change.

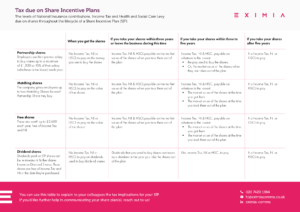

Download our breakdown of the different types of shares in a SIP and how they’re impacted by Income Tax, NI and HSCL:

And not to forget, if you’re promoting participation in your SIP, it’s certainly worth highlighting that employee contributions are made from pre-tax salary – saving even more with the upcoming NICs increase (subject to them staying in the Plan for five years of course)!

Share plans still support financial wellbeing

According to taxation.co.uk, “employee share schemes achieved a saving of £530m in income tax relief and £340m in National Insurance contributions in 2019-20.” This proves that paying into a share plan is a long-term investment, which could positively impact our future financial wellbeing.

However, at a time when financial stability is shaky for us all, many people will need reassurance about what this could mean, so that they’re empowered to do what’s best for them. Help those who are unsure about committing to a share plan to understand that the age-old adage ‘speculate to accumulate’ is true.

Offer share plan support using the power of communication

Communication alleviates fear and anxiety. With inflation and NI on the rise, you need to take a proactive approach in how you support your existing participants and those considering joining your plans.

Highlight the benefits of your plan and align it with current situations. For example, SIP and SAYE are flexible plans. With SAYE you can take a 12 month hiatus. With SIP you can stop and start contributions to suit. These options might be really important for your employees.

Think about offering relevant information at key points, even if it breaks your usual cycle of communications. Regularly communicating will empower your people to make the right decisions for them and their families.

We’ve got the technical knowledge and creative expertise to craft engaging communications for your share plan(s). Get in touch if you’d like help communicating your share plan messages.